Builders FirstSource (NYSE:BLDR) is down nearly 50% from its all-time highs. The company recently reported better-than-expected earnings per share, which has caught investors' attention. But when viewed through the lens of the Adhishthana Principles, there are structural risks that may keep the stock under pressure.

Builders FirstSource and Its Adhishthana Cycle So Far

The stock is currently in Phase 9 of its 18-phase Adhishthana cycle on the weekly charts, a phase that often decides whether strength or weakness dominates ahead.

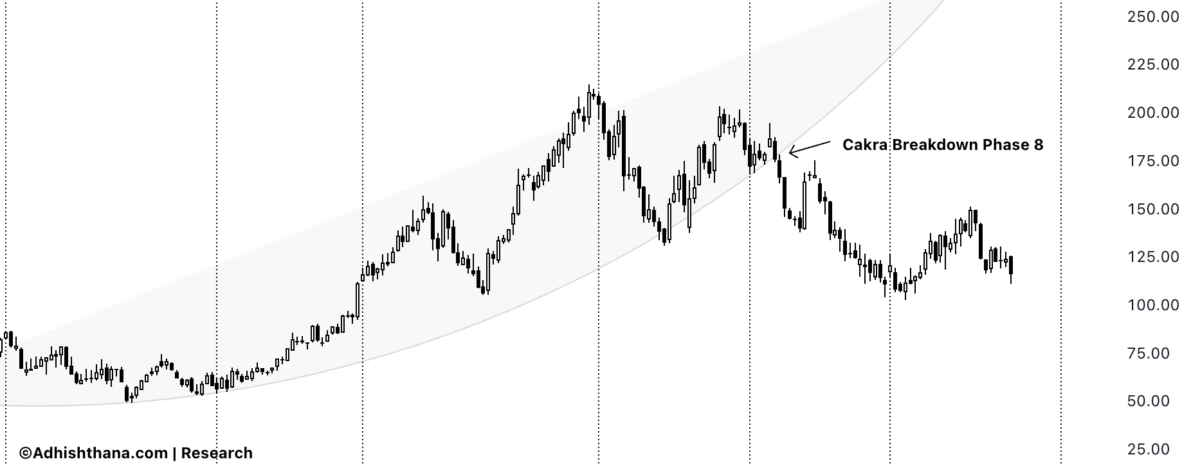

According to the Adhishthana Principles, stocks typically form a Cakra structure between Phases 4–8. This structure, often resembling a channel with an arc, generally carries bullish implications. A clean breakout in Phase 9 usually triggers the Himalayan Formation, marking the beginning of a powerful bullish rally.

Builders FirstSource entered its Phase 4 back in December 2021 and continued trading within its Cakra through Phase 7. However, as the stock transitioned into Phase 8, it broke down below the Cakra, triggering what's known as the Move of Pralaya.

As I explained in Adhishthana: The Principles That Govern Wealth, Time & Tragedy:

"When the underlying breaks the Cakra on the flip side, consolidation typically extends into the Guna Triads. The move that follows is highly significant, and selling pressure can be extremely strong. This is called the Move of Pralaya."

True to the principles, Builders FirstSource tumbled sharply after this breakdown, losing nearly 50% from its all-time highs.

Is It a Buy After Earnings?

Despite reporting a stronger EPS, the underlying trend tells a different story. With a Move of Pralaya in play, underperformance could extend until the stock enters its Guna Triads (Phases 14, 15, and 16).

The company's fundamentals also show weakness, where net income fell nearly 57% compared to the same period last year, reinforcing the structural signals from the Adhishthana framework.

A Cakra breakdown typically reflects deeper issues within a company's foundation, not just short-term volatility. As such, long-term investors might be better off waiting for a more stable setup before stepping in.

Also Read: Stride Slips After Earnings, But Can It Regain Footing?

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.