Shares of American Airlines Group Inc (NASDAQ:AAL) are trading lower Thursday afternoon in sympathy with competitor United Airlines Holdings Inc (NASDAQ:UAL), which reported its third-quarter financial results. Here’s what investors need to know.

- AAL shares are retreating from recent levels. Get the details here.

What To Know: While United reported adjusted earnings per share of $2.78, beating analyst estimates, other key metrics sparked concerns for the airline sector. United’s total operating revenue for the quarter was $15.2 billion, up 2.6% year-over-year, but below Wall Street’s consensus estimate.

Additionally, United's total revenue per available seat mile, a key indicator of pricing power and efficiency, declined by 4.3% compared to the third quarter of 2024. This drop in unit revenue suggests potential industry-wide weakness in pricing or demand relative to capacity.

The negative sentiment has dragged down American Airlines shares as investors worry the carrier may be facing similar or more pronounced headwinds, anticipating that these challenges could impact its upcoming earnings report.

American Airlines is due to report earnings on Oct. 23. The company is expected to report a loss of 28 cents per share and revenue of $13.63 billion, according to estimates from Benzinga Pro.

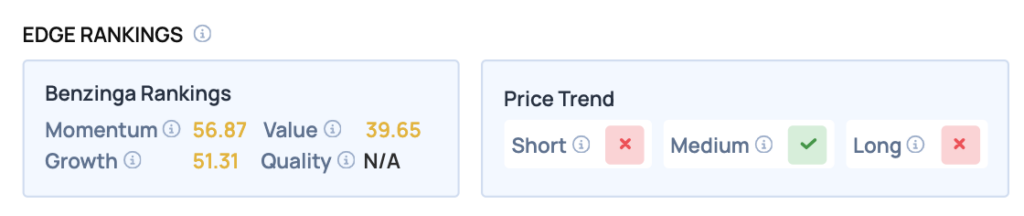

Benzinga Edge Rankings: According to Benzinga Edge stock rankings for American Airlines, the stock has a moderate Growth score of 51.31.

AAL Price Action: American shares were down 5.24% at $11.84 at the time of publication on Thursday, according to data from Benzinga Pro. The stock is trading within its 52-week range of $8.50 to $19.10.

From a technical perspective, the stock is currently trading below both its 50-day moving average of $12.41 and its 200-day moving average of $12.68, indicating a bearish trend in the short to medium term.

Read Also: Elon Musk’s Starlink Wi-Fi Now Available On United Airlines Flights

How To Buy AAL Stock

By now you're likely curious about how to participate in the market for American Airlines – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock