Solana (CRYPTO: SOL) and Cardano (CRYPTO: ADA) are flashing buy signals even as both coins plunge 8%.

Solana Price Defends $185 Channel Base As Bulls Eye Reversal

SOL Price Action (Source: TradingView)

Solana trades near $185, down 4.5% in the last session, as the market absorbs sharp volatility.

Despite the drop, technicals show SOL holding firm within its ascending channel that has guided price action since April.

The lower boundary, sitting around $180–185, has repeatedly acted as a rebound zone.

The 200-day EMA at $187 and the mid-Bollinger Band at $191 converge near the same level, reinforcing structural support.

$400M Solana Outflows Hint At Capitulation Before Next Rally

SOL Netflows (Source: Coinglass)

Data shows over $400 million in spot outflows from Solana over the past four days, including $111 million on October 30 alone.

Such deep withdrawals often mark capitulation phases where short-term holders exit and stronger hands accumulate.

If inflows return while price steadies above the current band, a breakout toward $220 and potentially $260 could follow.

For investors, the $180–185 range presents a clear accumulation zone with defined downside risk and strong upside potential.

Cardano Price Coils At Apex With Breakout Move On Deck

ADA Price Dynamics (Source: TradingView)

Cardano sits near $0.605, down 5.4% as pressure builds around its long-term horizontal base at $0.58–0.60.

The chart forms a descending triangle converging toward its apex -- a structure that typically precedes sharp breakouts.

Short-term EMAs cluster overhead, with the 50-day EMA at $0.67 and the 200-day EMA at $0.75 marking early resistance levels.

A decisive move above $0.70 would confirm bullish control, opening targets near $0.85 and potentially $1.00 into the next cycle.

Cardano Outflows Signal Market Reset And Bottoming Phase

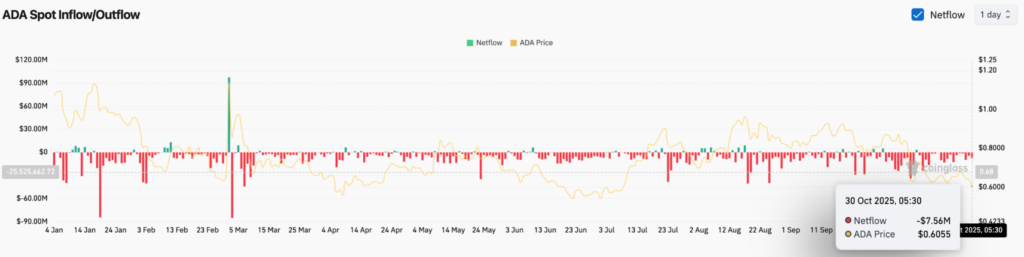

ADA Netflows (Source: Coinglass)

On-chain data shows $7.5 million in ADA outflows on October 30, extending a pattern of sustained selling pressure this month.

Historically, such net outflows tend to occur near local bottoms as weak positions unwind.

For long-term investors, ADA's $0.58–0.60 pocket represents a strategic entry with risk limited beneath $0.55 and reward potential toward $0.85 or higher.

Read Next:

- A Must See Chart for Those in the AI Trade; Trump Xi Meeting ‘Amazing’

Image: Shutterstock