In the last three months, 6 analysts have published ratings on Public Service Enterprise (NYSE: PEG), offering a diverse range of perspectives from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 1 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 2 | 0 | 2 | 0 | 0 |

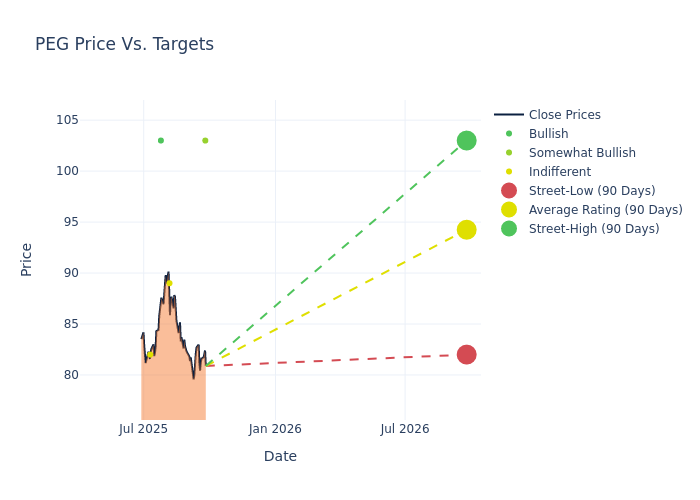

Analysts have set 12-month price targets for Public Service Enterprise, revealing an average target of $93.0, a high estimate of $103.00, and a low estimate of $82.00. Marking an increase of 3.71%, the current average surpasses the previous average price target of $89.67.

Diving into Analyst Ratings: An In-Depth Exploration

The analysis of recent analyst actions sheds light on the perception of Public Service Enterprise by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| David Arcaro | Morgan Stanley | Lowers | Overweight | $103.00 | $105.00 |

| James Thalacker | BMO Capital | Raises | Market Perform | $89.00 | $84.00 |

| William Appicelli | UBS | Raises | Buy | $103.00 | $97.00 |

| James Thalacker | BMO Capital | Raises | Market Perform | $84.00 | $83.00 |

| Nicholas Campanella | Barclays | Lowers | Equal-Weight | $82.00 | $83.00 |

| William Appicelli | UBS | Raises | Buy | $97.00 | $86.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Public Service Enterprise. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Public Service Enterprise compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Public Service Enterprise's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Public Service Enterprise's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Public Service Enterprise analyst ratings.

Get to Know Public Service Enterprise Better

Public Service Enterprise Group is the holding company for a regulated utility (PSE&G) and PSEG Power, which owns all or a share of three nuclear plans and clean energy projects. PSE&G provides regulated gas and electricity delivery services in New Jersey to a combined 4.3 million customers. Public Service Enterprise Group also operates the Long Island Power Authority system. In 2022, the company sold its gas and oil power plants in the mid-Atlantic, New York, and the Northeast.

Unraveling the Financial Story of Public Service Enterprise

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Public Service Enterprise displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 15.77%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Utilities sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 20.86%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Public Service Enterprise's ROE excels beyond industry benchmarks, reaching 3.54%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Public Service Enterprise's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.05% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a below-average debt-to-equity ratio of 1.41, Public Service Enterprise adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: What Are They?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.