ChargePoint Holdings Inc (NYSE:CHPT) shares are trading flat Wednesday morning as investors await the company's second-quarter earnings report, set to be released after the market close.

What To Know: The stock has been volatile in recent months, reflecting investor concerns over declining hardware sales, weaker-than-expected revenue and efforts to stabilize the business.

In June, ChargePoint reported first-quarter results that missed Wall Street expectations. Revenue came in at $97.6 million, down 9% year-over-year and below the $100.5 million consensus. Hardware sales fell sharply, though subscription revenue increased 14% to $38 million, helping gross margins improve to 29% from 22% a year earlier.

The company also projected second-quarter revenue between $90 million and $100 million, under the $108 million analyst estimate. Despite near-term weakness, management pointed to new partnerships, product rollouts and efficiency gains as potential long-term growth drivers. ChargePoint ended the first-quarter with $196.3 million in cash and no debt maturities until 2028.

In July, ChargePoint implemented a 1-for-20 reverse stock split aimed at boosting its share price to maintain compliance with NYSE listing requirements. The stock has remained under pressure since then as the market awaits clarity on the company's turnaround progress.

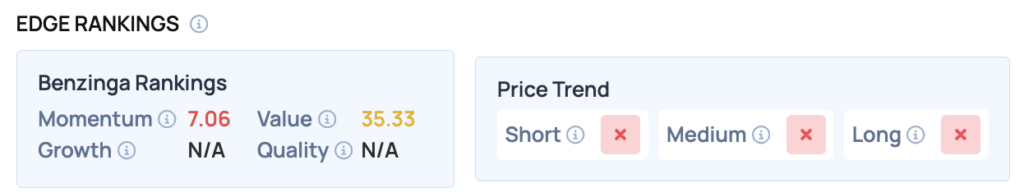

Benzinga Edge Rankings: Benzinga Edge members get an advantage with real-time portfolio alerts, actionable stock ideas and pro-grade tools that help them profit in any market.

Price Action: According to data from Benzinga Pro, CHPT shares are trading flat at $10.75 Wednesday morning. The stock has a 52-week high of $37.60 and a 52-week low of $8.55.

Read Also: Zscaler Q4 Earnings: Revenue Beat, EPS Beat, Strong Guidance, Shares Climb

How To Buy CHPT Stock

By now you're likely curious about how to participate in the market for ChargePoint – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock