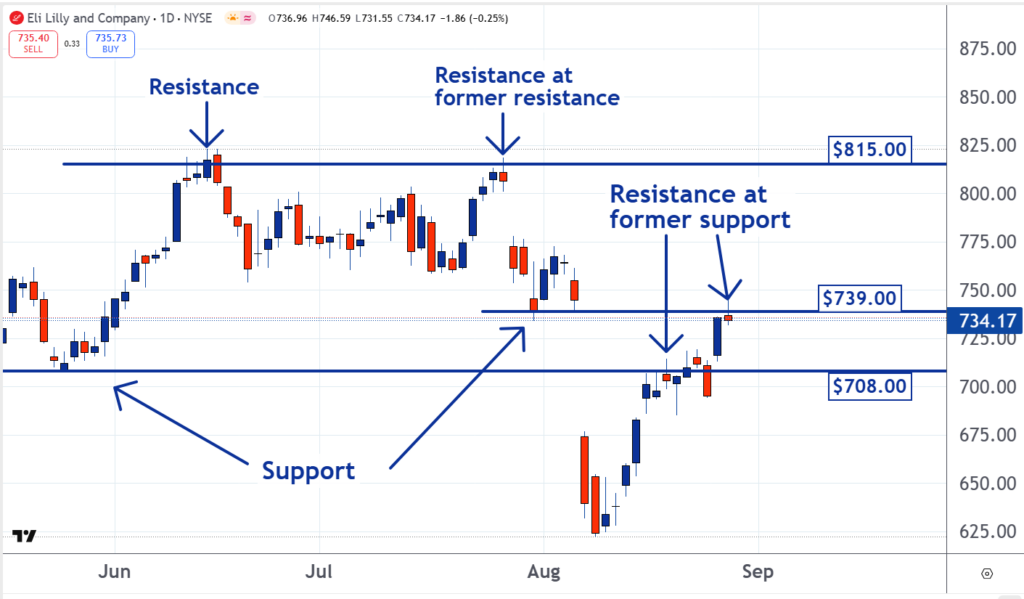

Trading is quiet in Eli Lilly and Co (NYSE:LLY) on Thursday. The stock has stalled out at a resistance level.

Resistance can form in markets because of regretful buyers trying to exit positions at breakeven. Eli Lilly is the Stock of the Day because its chart shows examples of this.

See how LLY stock is doing now here.

In June, the $708 level was support. Those who purchased shares at this price were happy because the stock rallied afterward.

But on Aug. 7, the support broke and the shares dropped below it. When this happened, some of the investors and traders who bought shares came to regret their decisions.

A number of them decided they would hold onto their losing positions, but also believed that if they could eventually sell them at breakeven, they would. So when the stock rallied back up to this price, sell orders were placed.

Read Also: Nvidia Q2 Guidance Shows Demand Outstrips Supply For ‘New Oil And Gold Of AI Revolution’

As you can see, this created resistance and the move higher stalled out.

Then the stock broke this resistance and a rally followed. Now it has run into resistance around $239. This level was support in late July and early August.

Now remorseful buyers who purchased shares then are selling, and it has caused resistance to form.

In addition to converting support levels into resistance, buyer remorse or regret can make resistance form at levels that had been resistance before. This can be seen with the $815 level on the chart.

It was resistance in June, and then it was resistance again in July.

People who purchased shares for around $815 in June regretted doing so when the price dropped. Some decided to sell at breakeven if they could eventually do so. When the price returned to $815 in August, they placed sell orders and this selling created resistance.

Stocks tend to make rapid moves higher after they break resistance, and this is what happened when Eli Lilly broke the $708 level. If it breaks the resistance at $739, another move higher may follow.

Read Next:

• US Economy Roars Back With 3.3% Growth, Shrugging Off Trump Tariffs

Photo: Shutterstock