TKO Group (NYSE:TKO) is nearing a critical point in its Adhishthana cycle. The stock is currently in Phase 17 out of 18 on the weekly chart, a stage that often sets up for strong bullish momentum ahead. However, while a Nirvana move is highly probable in the next phase, the short-term picture points to a likely pullback before the bigger rally begins.

Here is how the structure is unfolding under our proprietary Adhishthana framework and what investors should keep in mind.

Why TKO Looks Set for Bullish Momentum

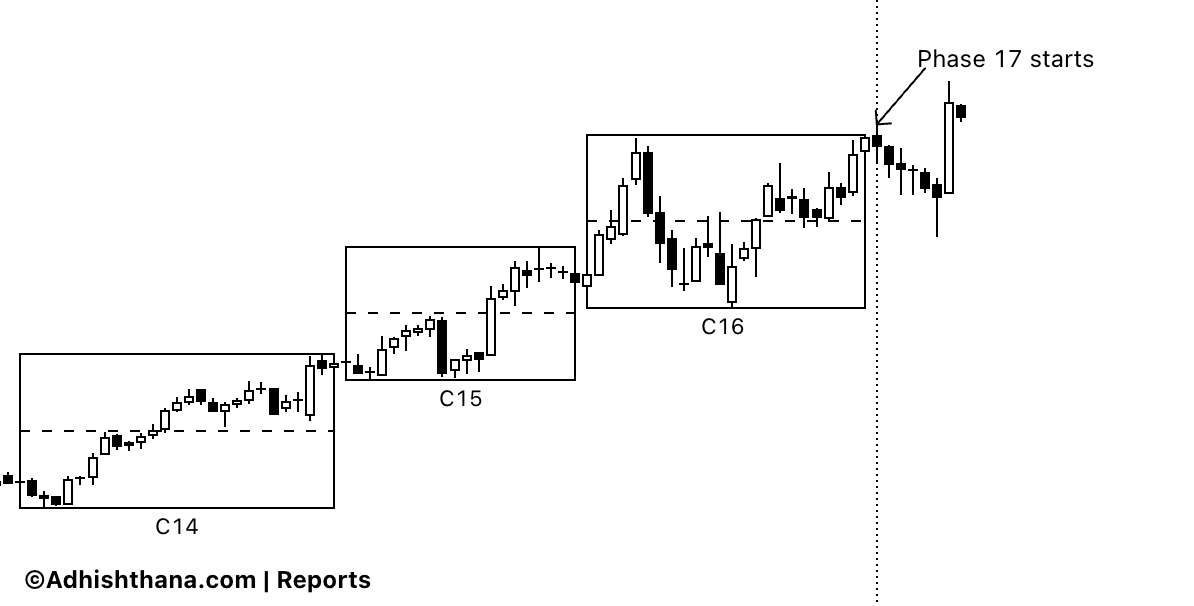

Within the Adhishthana cycle, Phases 14, 15, and 16 form the Guna Triads. These are the decisive stages that determine whether a stock can achieve Nirvana in Phase 18, the highest point of the cycle.

For Nirvana to occur, the triads must show the presence of Satoguna, which represents a clean and powerful bullish structure.

In TKO's case, both Phase 14 and Phase 15 displayed clear bullish strength. This suggests that once Phase 17 completes, the conditions will be in place for a full-scale Nirvana rally beginning in January 2026, when Phase 18 officially starts.

Why a Pullback Is Likely in the Short Term

While the long-term picture is bullish, the monthly chart suggests near-term weakness. TKO is currently in Phase 8, navigating the Adhishthana Cakra formation.

Phases 4 through 8 typically form an arc-like structure, often bullish in nature, with the breakout arriving in Phase 9. That breakout usually marks the beginning of the Adhishthana Himalayan formation.

The challenge for TKO is timing. The stock is already trading above its breakout level, but this is happening within Phase 8, rather than in Phase 9. According to the framework, breakouts that occur in the wrong phase are rarely sustainable. The forces of the cycle usually push the stock back into its Cakra range before a true breakout can take place.

As a result, TKO may retest the lower boundary of its Cakra formation one last time before aligning with the Nirvana rally on the weekly cycle.

Investor Outlook

TKO Group's long-term structure remains bullish, with a high probability of a Nirvana move in Phase 18. However, the stock's premature breakout on the monthly chart suggests a near-term pullback is still in play.

- Existing investors should prepare for potential downside before the larger rally resumes. Hedging strategies may help manage risk until Phase 18 begins.

- New investors may want to wait for the pullback to materialize, as it could provide a more attractive entry point into the stock ahead of the Nirvana phase.

For now, TKO's setup is one of patience. The long-term upside is compelling, but the near-term picture calls for caution.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.