The week ended with Bitcoin prices falling from their high water market, but good luck finding a single BTC investor that is worried about it. This market has long legs, so long in fact we now have mainstream analysts from Cantor Fitzgerald making price calls of $1 million, Barron's reported exclusively last week.

“Bitcoin’s recent surge past $120,000 isn’t just a price spike, it’s a clear indicator of its maturing market and strengthening fundamentals," said Marvin Bertin, co-founder and CEO of Maestro, a leading BitcoinFi infrastructure provider. They raised $3 million in seed funding in February, helped along by crypto savant Tim Draper at Draper Associates, along with co-investor Wave Digital Assets.

"Individuals and institutions globally seek reliable, independent assets, and Bitcoin continues to prove its value in being just that. The recent highs are fueled by increasing institutional adoption, the accessibility offered by new Bitcoin ETFs, and the halving event, which limits supply, making Bitcoin scarcer,” Bertin said.

The last Bitcoin halving was in April 2024. Bitcoin is programmed to halve its block reward every 210,000 blocks to control supply and reinforce scarcity, capping total issuance at 21 million Bitcoin. This action occurs every four years. Historically, halvings have been followed by multi-month--even multiyear--price rallies, as reduced supply meets steady or rising demand.

In the last week of July, Bitcoin traded mostly between $117,000 and $120,000, with modest volatility and an overall flat-to-slightly-down performance. Notable dips below $118,000 occurred later in the week with late Friday trading bringing it down to around $113,000. (It was trading higher by end of the weekend.)

Some $2.2 trillion of Bitcoin value is held by investors large and small, worldwide. To put that number into perspective, that is the market cap of the Frankfurt Stock Exchange.

"The fact that Bitcoin is sitting near all time highs shows me that it has real world conversion – it is an economic store of value," Anthony Pompliano, author of the famous Pomp Letter, said on his YouTube show on July 30. The show title spoke volumes: "The Bitcoin Bull Run is Far From Over."

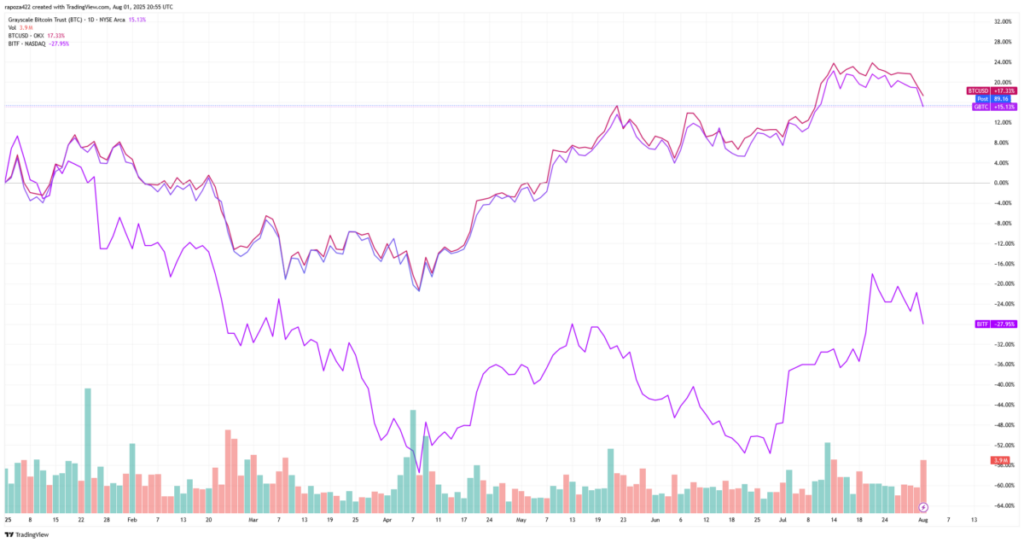

Image Source: TradingView

Pompliano would definitely agree with Cantor Fitzgerald, which seems to have hopped on the Bitcoin bandwagon.

"Bitcoin is well primed for more price appreciation," he said. "Every once in a while you will get these corrections of 15% to 30%, but that is a healthy draw down for the Bitcoin market."

Bitcoin reached a new all-time high of $123,218 on July 14, rising nearly 10% that month. Crypto ETF demand continues to be a "safe haven" for investors who don't want to go through the hassle of opening an account on a cryptocurrency exchange and risk hackers. ETFs are bringing in untold new numbers of investors to this space.

In 2024, U.S. stocks and gold gained 25% and 27%, respectively, but BTC was a better bet, up 120%. The market's largest cryptocurrency led the way over the past five years, with a 58% annualized return. Since the Security and Exchange Commission's approval of new Bitcoin ETFs in early 2024, assets under management (AUM) in cryptocurrency funds reached $150 billion.

"Interest in Bitcoin is getting a big boost from the political environment," wrote Wellington Management investment strategists led by digital assets director Mark Garabedian.

"The Trump administration has voiced support for bitcoin and cryptocurrency in general," they wrote in March, prior to the recent passing of the GENIUS Act, among others during "Crypto Week" on Capitol Hill in mid-July.

Investors have welcomed the change, despite the sell-off. For big traditional money managers like Wellington, they believe these latest laws could provide more support for Bitcoin as an investment in the years ahead.

The author is invested in the Grayscale Bitcoin Trust and in Bitfarms.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.