Trading in shares of Live Nation Entertainment, Inc. (NYSE:LYV) is quiet Wednesday. This follows yesterday's sell-off of 6.5%.

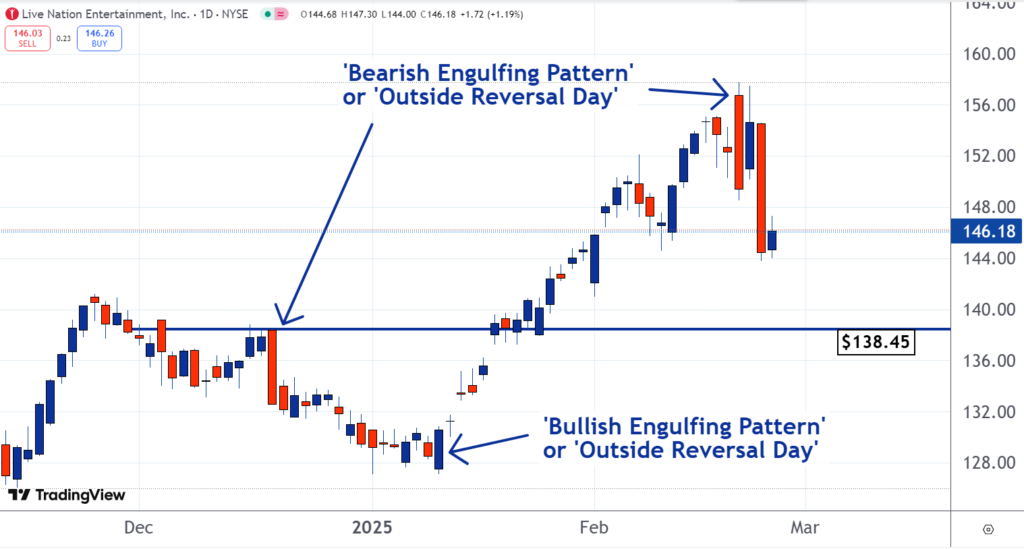

There is a chance the stock will continue to head lower. If it does, there may be some support around $138.45 and this could put a floor underneath it. This is why our technical analysts have made it our Stock of the Day.

As you can see on the chart, there was resistance at this level in December. When the stock headed lower soon after, many traders and analysts who sold thought they made a good decision. But when resistance broke and the price moved higher, some regretted selling.

They decided to buy their shares back if they could at the same price they were sold at. So, if the stock returns to this level these remorseful sellers will be placing buy orders. If there are enough of them, it will form support at the price that had been resistance.

Read Also: Nvidia Earnings On Deck, SMCI Regains Compliance: What’s Driving Markets Wednesday?

The stock may even rally if the bulls take over. This is what happened on Jan. 13.

In the morning, it looked like the downtrend was going to continue. The stock opened at a lower price than the previous day's close.

But by the end of the day, the bulls overpowered the bears and took over. The closing price ended up being higher than the prior day's opening price. The trading “engulfed” the prior day's range.

This appears as a bullish engulfing pattern on the chart. It is a graphical illustration of the change in leadership from bears to bulls.

The recent downtrend began after a bearish engulfing pattern formed.

On Feb. 21 it looked like the uptrend was going to continue. The stock opened at a higher price than the previous day's close.

But by the end of the day, the bears overpowered the bulls and pushed the price lower. It ended up closing below the prior open. The trading range “engulfed” the range of the previous day.

Sometimes the change in leadership of a market takes place over an extended period of time. But sometimes it can happen in a single day. If so, an “engulfing” pattern may form on the chart.

Read Next:

• Man Who Lost $775 Million Bitcoin Hard Drive Faces New Setback: Recovery Chances Are 1 In 902 Million, Waste Expert Claims

Photo: Shutterstock