Iris Energy Ltd (NASDAQ:IREN) released results for the first quarter on Tuesday.

Iris reported first-quarter Bitcoin (CRYPTO: BTC) mining revenue of $49.6 million. The company reported a 28% increase in AI Cloud Services revenue quarter-over-quarter to $3.2 million.

Adjusted EBITDA was $2.6 million in the quarter. The company said it mined 813 bitcoin in the period and ended the quarter with $98.6 million in cash and cash equivalents. Iris noted that it had $182.4 million in cash as of Oct. 31.

"We are pleased to report our Q1 FY25 results and reiterate our focus on low-cost Bitcoin mining, operating cashflows and shareholder returns," said Daniel Roberts, co-founder and co-CEO of Iris Energy. "We are just weeks away from achieving our 31 EH/s milestone and are excited to announce the acceleration of our growth trajectory to 50 EH/s in H1 2025, which was previously H2 2025."

Iris Energy shares gained 29.1% to trade at $12.34 on Wednesday.

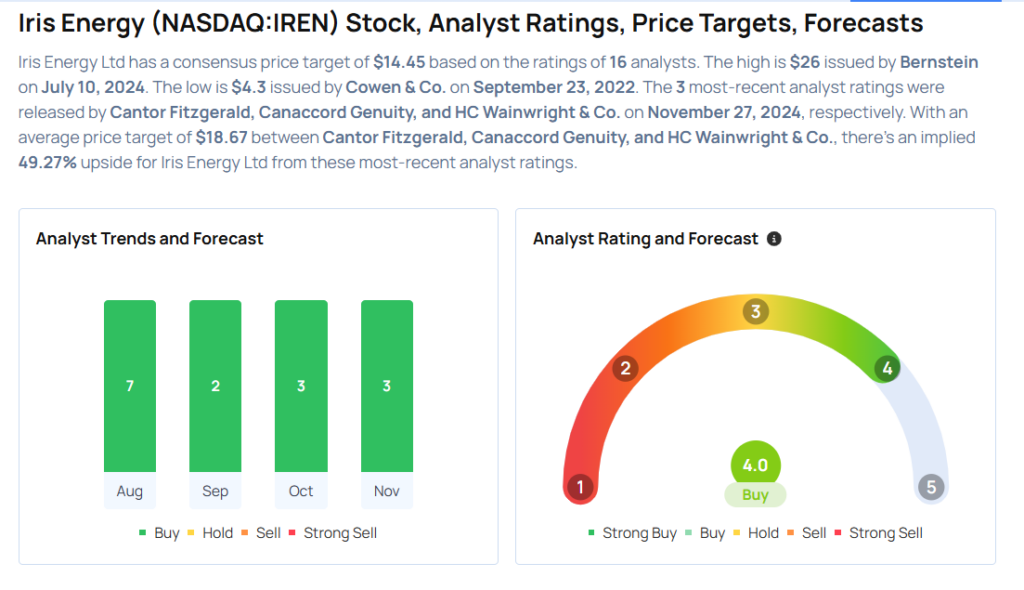

These analysts made changes to their price targets on Iris Energy following earnings announcement.

- HC Wainwright & Co. analyst Mike Colonnese maintained Iris Energy with a Buy and raised the price target from $13 to $16.

- Canaccord Genuity analyst Joseph Vafi maintained Iris Energy with a Buy and raised the price target from $15 to $17.

- Cantor Fitzgerald analyst Brett Knoblauch maintained the stock with an Overweight and boosted the price target from $20 to $23.

Considering buying IREN stock? Here’s what analysts think:

Read This Next:

- Urban Outfitters To Rally Around 47%? Here Are 10 Top Analyst Forecasts For Wednesday